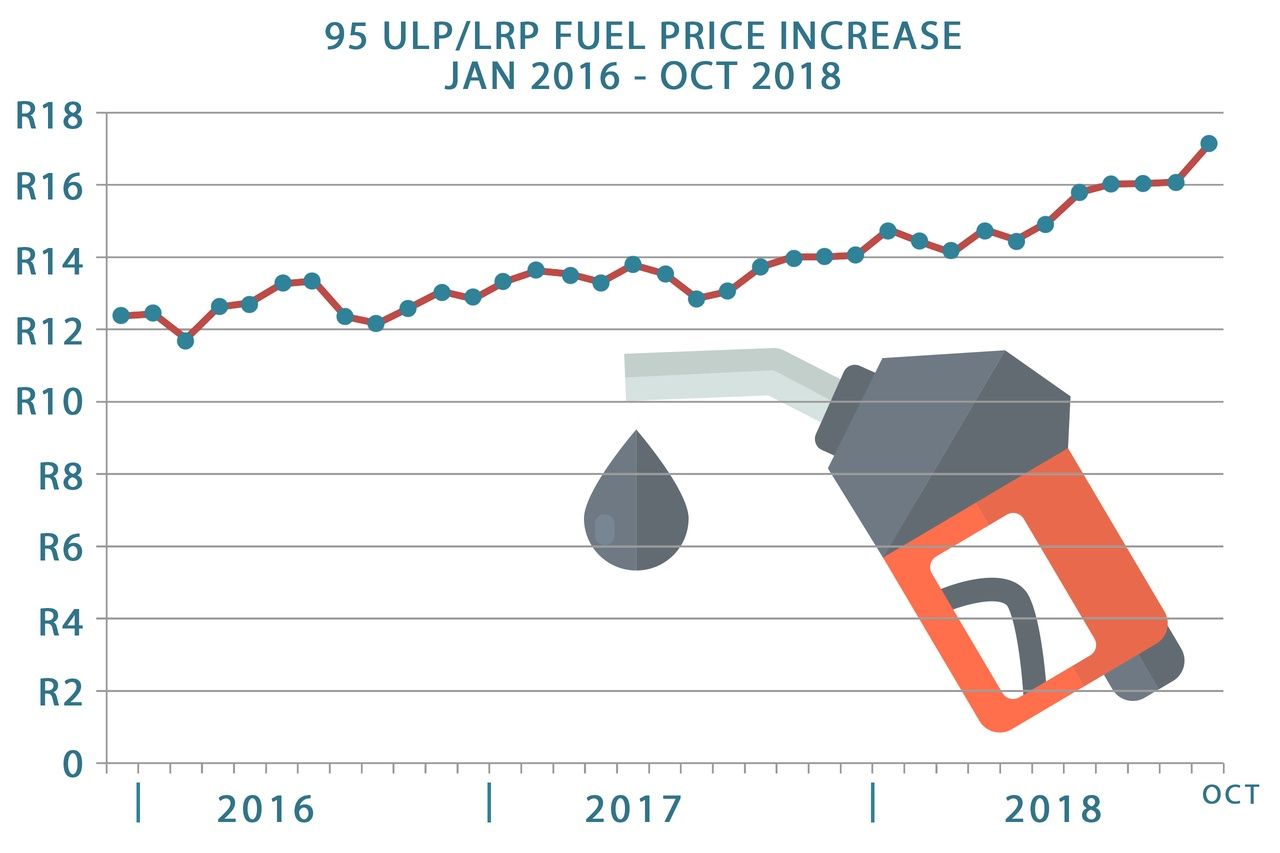

It’s been a tough couple of months for South African motorists, as the country has seen fuel price hikes for 7 consecutive months – and there’s no sign of any relief just yet. With the current fuel price for Unleaded 95 standing at an eye-watering R17.08 per litre, the price of petrol won’t only affect the pockets of motorists heavily, but it will also have a massive ripple effect on consumer products as transport fees of basic goods are set to skyrocket. As South Africans witnessed its biggest fuel price hike in history – a whopping R1.00 – many were left asking one question: what are we really paying for? And the short answer is: lots of things.

We take a quick look at what the final petrol price per litre is actually made up of – from various levies to distribution and transport fees. We’ve also include a quick explanation for each of the fee categories listed below.

DEFINITIONS

- Wholesale Margin: This is what government pays the various oil suppliers per barrel.

- Storage: When oil arrives on our shores, it needs to be stored at coastal terminals until it’s transported inland. This fee also includes handling fees at the harbour. The fee is calculated on a per-litre basis.

- Distribution: This is the fee payable for the transport and delivery of each litre of petrol.

- Retail Profit Margin: This is a fixed margin set by the Department of Energy and is calculated based on the actual costs incurred by the petrol station operator when selling petrol. This includes rental, interest, labour, any overheads and entrepreneurial compensation.

- Zone Differential: This is an extra fee payable in areas further away from the storage terminals. The further the petrol needs to be transported, the higher the Zone Differential will be.

- General Fuel Levy: This is the tax motorists pay for each litre of petrol.

- Customs & Excise Duty: A levy collected by South African Customs upon delivery of the barrels at the harbour.

- Road Accident Fund: This fee is applicable to both petrol and diesel. This levy is determined by the Minister of Finance and the income generated from this fee is used to compensate third-party victims of car accidents.

- Petroleum Products Levy: This is a mandatory fee paid to SARS on all petroleum-based products.

- DSML: This stands for Demand Side Management on 95 Unleaded Petrol (ULP) and only applies to inland motorists using 95 ULP. This fee was implemented when 95 ULP was introduced to inland regions for the first time. The purpose of this fee was to prevent excessive use of 95 ULP in inland areas as it would result in “octane waste”. Pump Rounding: This is an agreement between government and oil suppliers to round off the amount to the next whole cent. This is to ensure they don’t gain or lose as a result of the price difference between coastal and inland areas.

- Contribution to Basic Fuel Price: The Basic Fuel Price (BFP) is the amount government pays in US cents per litre and is determined by the Rand/US Dollar exchange rate.

Sources: Central Energy Fund | Department of Energy | Automobile Association of South Africa